This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet’s Stock Market Today for Feb. 9, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 12:00 p.m. ET

Midday Update

Heading into the afternoon, our earlier update still stands. The Nasdaq (+1.22%), Russell 2000 (+0.97%), and S&P 500 (+0.66%) are all advancing, while the Dow (-0.06%) stays just outside the gains.

Four S&P sectors are declining, including staples (-0.87%), health care (-0.83%), financials (-0.14%), and utilities (-0.08%). Those losses are more than sufficiently being made up by gains in technology (+1.69%), communication (+1.07%), and materials (+0.76%), among others.

Midday Movers

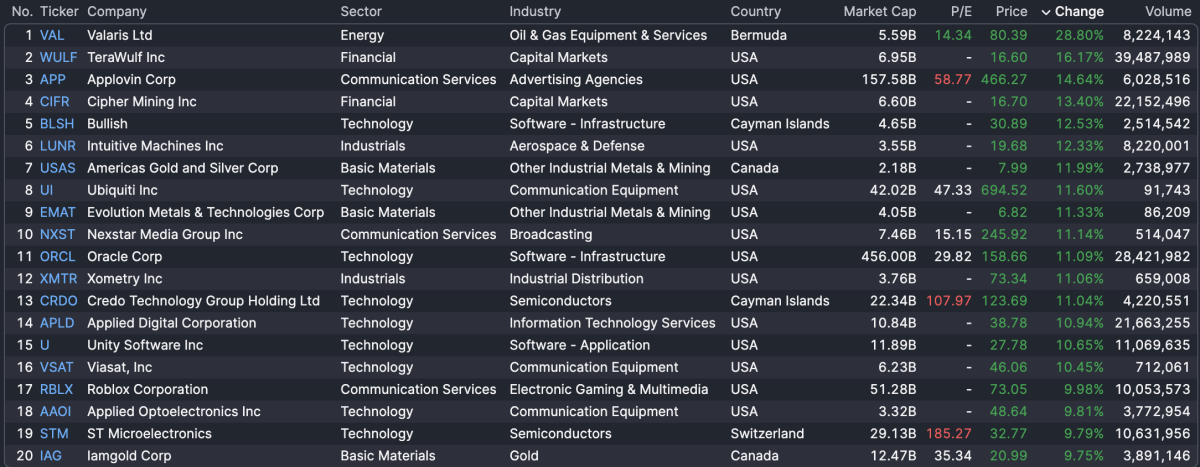

From here, we can turn our attention to the Midday Movers for today, the top and bottom 25 stocks on markets with at least a $2 billion market cap:

Winners

Valaris Ltd (+28.8%) is the top stock of the day after announcing that it will be acquired by Transocean (+1.76%) in a $5.8 billion deal.

It’s trailed by TeraWulf (+16.2%), which is jumping after Morgan Stanley initiated the stock at Overweight, tacking on a $37 price target.

Applovin Corp (+14.6%) rounds out the top three, rising after a recent short-seller report which connected the firm with “transnational crime syndicates”, was retracted.

Losers

On the other side of the market, Kyndryl Holdings (-55.2%) is today’s steepest decliner after the IBM spinoff announced the departure of its CFO amid a review of the firm’s accounting.

As we talked about earlier, Hims & Hers Health (-24%) is also among today’s biggest decliners after it was made to pull its GLP-1 products from the market; that was nearly all of the company’s growth over the last year.

Rounding out the top three, Monday.Com (-22%) fell after missing earnings.

Update: 11:01 a.m. ET

Stocks Turn Green on Day

After a mediocre start to the stay, tech and chip stocks have changed direction, putting most U.S. benchmarks back in the green. Over half of U.S. issues are now advancing, a small but meaningful turnaround from the opening minutes of trading.

Maybe helping matters is the NY Fed’s Inflation Expectation report, which was just released. It showed that the median one-year ahead expectations declined month-over-month to 3.1%, the lowest rate reported in the survey since Jul. 2025.

Update: 9:30 a.m. ET

Opening Bell

The U.S. markets are now open for the week. Barely 15 minutes after the market opened, the Nasdaq (+0.17%) and S&P 500 (+0.09%) are up a few basis points. Meanwhile, the Dow Jones (-0.28%) and Russell 2000 (-0.20%) are facing declines after a fantastic Friday of trading for the respective indexes.

It’s too early to celebrate now though. Analysts at Goldman Sachs warned this weekend that last week’s surprising selloff might continue this week as institutional investors might consider further selling, a matter further exacerbated the recent tumult in commodity and crypto markets. Let’s dive into those big developments:

Commodities & Crypto Move

To that end, continuous futures in gold (+1.45% to $5,052) and silver (+4.61% to $80.44) have been seen rebounding after hefty declines over the last week. The two were seen as high as $5,626, and $121 respectively. Crypto has also seen a bounce after a steep selloff put cryptocurrencies like bitcoin (-2.7% to $69,226) and ethereum (-3.87% to $2,039.53) off more than 20% last week.

Those moves in commodities and crypto also offer a guide for how things could play out with equities, especially given recent interest in these assets among retail investors. While the recent selloff was likely connected per reports — the result of an unwind trade involving crypto, commodities, and equities — the ‘kindred spirits’ of the market are known to be more sensitive to large swings in assets. For that, we’ll have to keep an eye on these moves.

S&P 500 Heatmap

Just a few minutes after the market open, here’s how things are looking with the S&P 500 index:

Alphabet’s 100-Year Bond Issue

Google parent Alphabet is preparing a 100-year bond, the first corporate issue of this length from a tech firm since Motorola’s 1997 issuance. The super-sized debt sale is likely to benefit the firm’s skyrocketing capital expenditures. At this juncture, it appears to be a $15 billion raise, but received over $100 billion worth of orders.

Other Stories of Note

Also notable this morning, Oracle (+6%) is having its best intraday performance since December, we’ll have to see if that holds. These gains put them apart from the broader S&P 500 Tech sector, which isn’t even up 1% so far this morning.

On the flip side, one-time retail favorite Hims & Hers (-26%) is getting hammered after it announced it would stop selling compounded weight loss products on Saturday, a decision brought on by possible FDA action.

Crypto stocks are once again declining as digital assets declined over the weekend, undoing a portion of their comeback trade. Treasury businesses Strategy (-5%) and exchanges like Coinbase (-0.91%) are among the names tumbling today.

Update: 7:16 a.m. ET

A.M. Update

Good morning. This morning, U.S. futures are mixed after a healthy start to the futures trading session on Friday night. Stocks are buoyed today by optimism surrounding Friday’s comeback trade and a landslide win for Japan’s Liberal Democratic Party (LDP) in the country’s weekend election.

Most of you already know about the former, where the Dow surpassed 50K for the first time and the Russell 2000 put up a stellar performance. But in case you need a refresh, here’s our SMT thread for then:

The latter was a big market-mover in Japan, where the overwhelming victory of Prime Minister Sanae Takaichi’s party was read as a positive indicator for Japan’s economy and cost-of-living crisis. The country’s Nikkei 225 index surpassed 57,000 for the first time. However, there remain worries that the party’s embrace of aggressive fiscal policy could result in wider depreciation of the yen.

It might end up being the first major macroeconomic shakeup this week. With the resignation of two senior officials in the cabinet of United Kingdom Prime Minister Keir Starmer, it might be well that the country’s Labour party will be shopping for a new leader, with possible geopolitical implications of their own.

Here’s a look at what is on deck for today:

Earnings Today: Apollo Global, Becton Dickinson & Co, Arch Capital

This morning, there were a handful of big earnings, led by Apollo Global Management. In addition, Becton Dickinson & Co, Loews Corp, and Waters Corp were among the other large reports from the pre-market session.

After the market closes, we’ll have a handful of other reports on our hands. Here are the reports coming up:

Economic Events: Consumer Inflation Expectations, Fed Speeches

Today will be a light day for economic data and events, with Consumer Inflation Expectations at 11:00 a.m. ET and a handful of speaking engagements for Fed leaders today. Here is the slate: